Understanding 1099-NEC Requirements: Your Guide from Sai CPA Services (Business Opportunities - Other Business Ads)

USNetAds > Business Opportunities > Other Business Ads

Item ID 133365980 in Category: Business Opportunities - Other Business Ads

Understanding 1099-NEC Requirements: Your Guide from Sai CPA Services | |

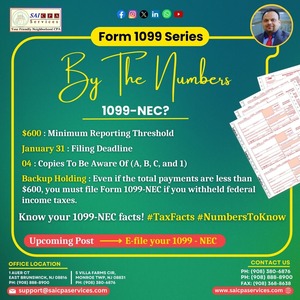

As tax season approaches, understanding your 1099-NEC obligations is crucial for both businesses and independent contractors. At Sai CPA Services, we're committed to helping you navigate these requirements effectively. Key Thresholds The most important number to remember is $600. If you've paid a contractor or received non-employee compensation totaling $600 or more during the tax year, a 1099-NEC must be filed. This threshold applies to each individual contractor, not the cumulative amount paid to all contractors. Critical Deadlines January 31: This is the deadline for both providing Copy B to contractors and filing Copy A with the IRS. Unlike some other tax forms, there's no automatic 30-day extension available. February 15: If you're reporting payments with backup withholding, this deadline applies for filing with your Form 945. Important Forms to Know The 1099-NEC includes multiple copies: Copy A: Submitted to the IRS Copy B: Provided to the contractor Copy C: For the payer's records Copy 1: For state tax department, if required Special Considerations Even if payments are below the $600 threshold, you must file a 1099-NEC if you've conducted any backup withholding. Additionally, payments made via credit card or third-party payment networks (like PayPal) should not be included on Form 1099-NEC; these are reported on Form 1099-K instead. For expert guidance on 1099-NEC reporting requirements or other tax matters, contact Sai CPA Services. We're here to ensure your compliance while maximizing your tax efficiency. Contact Us : Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876 (908) 888-8900 1 Auer Ct, East Brunswick, NJ 08816 #TaxSeason #1099NEC #BusinessTax #TaxCompliance #SmallBusiness  | |

| Related Link: Click here to visit item owner's website (0 hit) | |

| Target State: New Jersey Target City : East Brunswick Last Update : Jan 28, 2025 2:46 PM Number of Views: 114 | Item Owner : Saicpa Contact Email: Contact Phone: +1 9083806876 |

| Friendly reminder: Click here to read some tips. | |

USNetAds > Business Opportunities > Other Business Ads

© 2025 USNetAds.com

GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | INNetAds.com | CNNetAds.com | Hot-Web-Ads.com | USAOnlineClassifieds.com

2025-04-01 (0.409 sec)