SAI CPA Services | (908) 888-8900 | W-2 Filing Deadlines (Business Opportunities - Other Business Ads)

USNetAds > Business Opportunities > Other Business Ads

Item ID 133368074 in Category: Business Opportunities - Other Business Ads

SAI CPA Services | (908) 888-8900 | W-2 Filing Deadlines | |

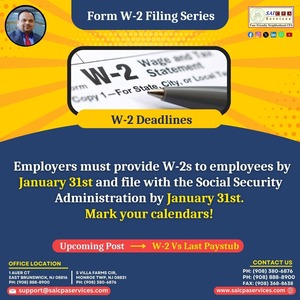

As tax season approaches, SAI CPA Services reminds employers of the crucial January 31st, 2024 deadline for W-2 filing obligations. This applies to both employee distribution and Social Security Administration submissions. Employers must provide Form W-2 to all employees who received compensation during 2023, with electronic filing mandatory for businesses submitting 250+ forms. Missing deadlines incurs penalties ranging from $50 to $280 per form. To ensure compliance, verify employee information, double-check calculations, and maintain proper records. For expert assistance, contact SAI CPA Services Contact Us : Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876 (908) 888-8900 1 Auer Ct, East Brunswick, NJ 08816 #TaxSeason #W2Filing #PayrollTax #BusinessCompliance #TaxDeadlines #Saicpaservices  | |

| Related Link: Click here to visit item owner's website (1 hit) | |

| Target State: New Jersey Target City : East Brunswick Last Update : Jan 29, 2025 1:48 PM Number of Views: 133 | Item Owner : Saicpa Contact Email: Contact Phone: +1 9083806876 |

| Friendly reminder: Click here to read some tips. | |

USNetAds > Business Opportunities > Other Business Ads

© 2025 USNetAds.com

GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | INNetAds.com | CNNetAds.com | Hot-Web-Ads.com | USAOnlineClassifieds.com

2025-04-01 (0.638 sec)