Sai CPA Services | Tax Deadline: March 15th – Act Now! (Business Opportunities - Other Business Ads)

USNetAds > Business Opportunities > Other Business Ads

Item ID 133420598 in Category: Business Opportunities - Other Business Ads

Sai CPA Services | Tax Deadline: March 15th – Act Now! | |

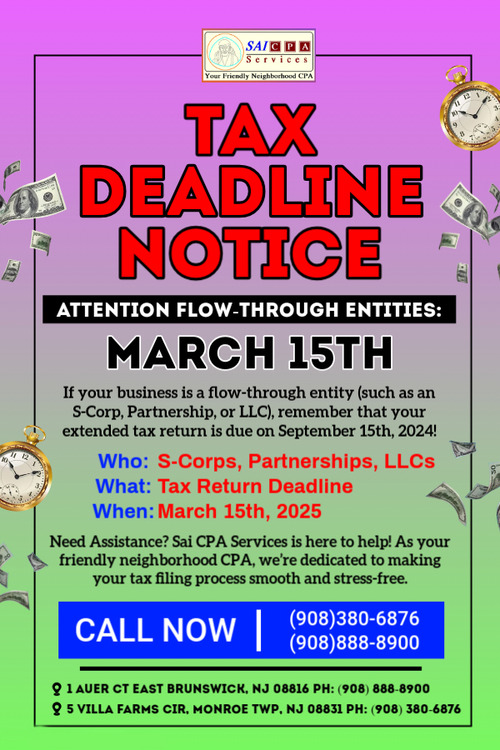

Attention business owners! If your company operates as a flow-through entity—such as an S-Corporation, Partnership, or LLC—your tax return deadline is March 15th, 2025. This is a crucial date to remember, as missing it can result in penalties and unnecessary stress. Flow-through entities do not pay taxes at the corporate level. Instead, income is passed through to the owners, who report it on their individual tax returns. This makes timely filing essential to avoid delays in personal tax obligations. If you require more time, you can file for an extension, pushing your deadline to September 15th, 2025. However, keep in mind that an extension only gives you more time to file, not to pay any taxes due. At Sai CPA Services, we understand that tax season can be overwhelming. Our experienced team is here to assist with accurate tax preparation, ensuring compliance with IRS regulations while maximizing your deductions. Whether you need help filing your return or requesting an extension, we’ve got you covered! Don’t wait until the last minute! Contact Sai CPA Services today to ensure a smooth and stress-free tax filing process. Contact Us : Facebook: AjayKCPA Instagram: sai_cpa_services Twitter: SaiCPA LinkedIn: Sai CPA Services WhatsApp: Sai CPA Channel Phone: (908) 380-6876 (908) 888-8900 1 Auer Ct, East Brunswick, NJ 08816 #TaxDeadline #March15 #DeadlineMarch15 #FlowThroughEntities #SmallBusinessTaxes #SCorp #LLC #Partnership #SaiCPAServices #TaxFiling  | |

| Related Link: Click here to visit item owner's website (0 hit) | |

| Target State: New Jersey Target City : East Brunswick Last Update : Mar 04, 2025 10:12 AM Number of Views: 37 | Item Owner : Saicpa Contact Email: Contact Phone: +1 9083806876 |

| Friendly reminder: Click here to read some tips. | |

USNetAds > Business Opportunities > Other Business Ads

© 2025 USNetAds.com

GetJob.us | CANetAds.com | UKAdsList.com | AUNetAds.com | INNetAds.com | CNNetAds.com | Hot-Web-Ads.com | USAOnlineClassifieds.com

2025-03-05 (0.411 sec)